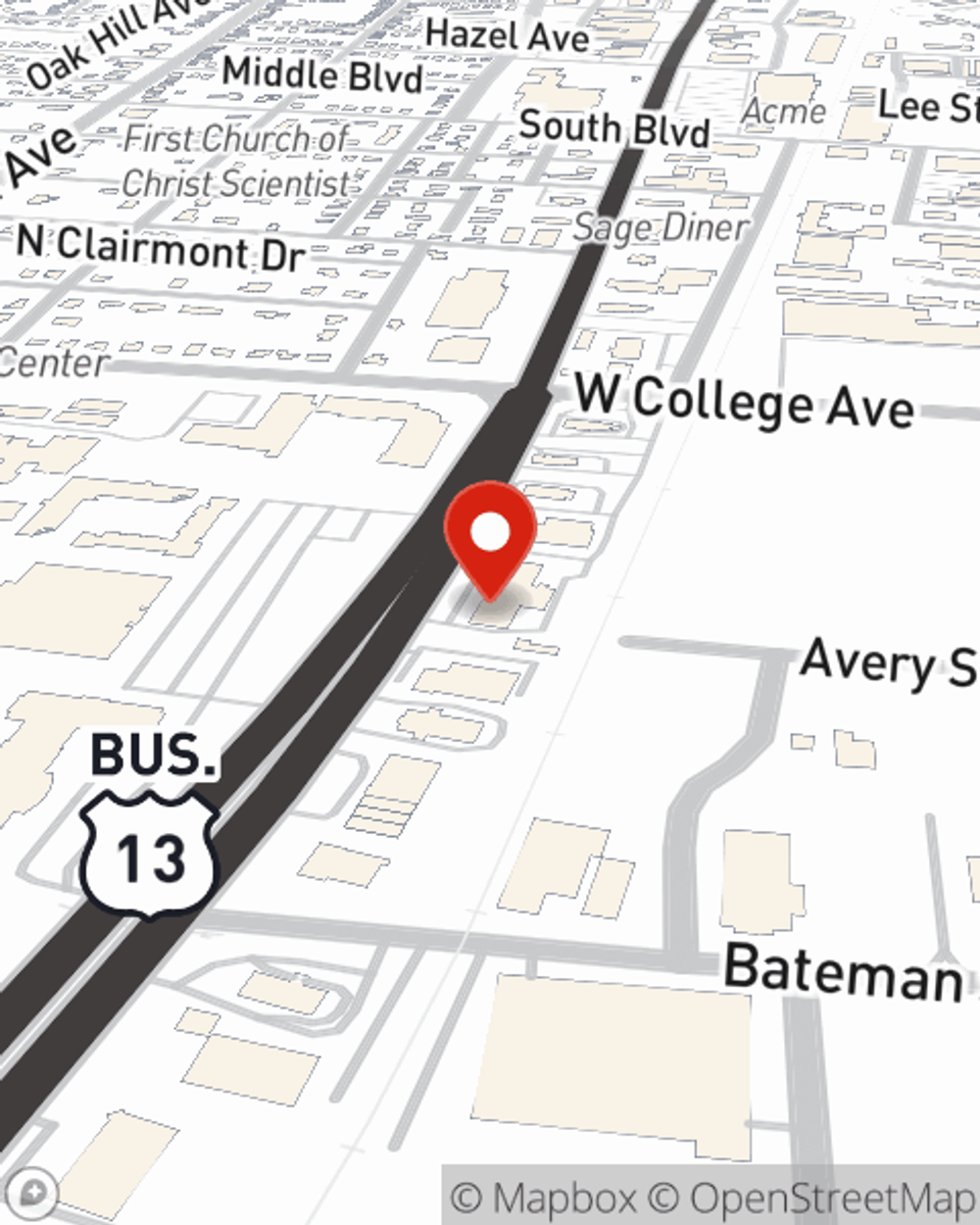

Business Insurance in and around Salisbury

Calling all small business owners of Salisbury!

Cover all the bases for your small business

This Coverage Is Worth It.

Small business owners like you wear a lot of hats. From HR supervisor to inventory manager, you do whatever is needed each day to make your business a success. Are you an acupuncturist, an HVAC contractor or a pharmacist? Do you own an auto parts shop, an appliance store or a tailoring service? Whatever you do, State Farm may have small business insurance to cover it.

Calling all small business owners of Salisbury!

Cover all the bases for your small business

Insurance Designed For Small Business

Your small business is unique and faces a wide array of challenges. Whether you are growing a bicycle shop or a bagel shop, State Farm provides a large range of small business insurance options to help your business thrive. Depending on your business type, you may need more than just business property insurance. State Farm Agent Tom Prunty can help with worker's compensation for your employees as well as commercial auto insurance.

Let's discuss business! Call Tom Prunty today to learn why State Farm has been rated one of the top overall choices for insurance coverage by small businesses like yours.

Simple Insights®

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.

Sharing the road with farm vehicles

Sharing the road with farm vehicles

Rural driving might be relaxing but these roads are shared with farm vehicles and can have risks. Here are tips to help when driving in rural areas.

Tom Prunty

State Farm® Insurance AgentSimple Insights®

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.

Sharing the road with farm vehicles

Sharing the road with farm vehicles

Rural driving might be relaxing but these roads are shared with farm vehicles and can have risks. Here are tips to help when driving in rural areas.